Growth in globalization was accompanied by a growth in international money transfers. International money transfers can be conducted any time of the day for 7 days a week now. This raises some important questions — When should you send money ? How do you get best remittance rate?

We analyzed currency rates available through various remittance providers to identify patterns. Here we discuss our key findings.

Avoid weekends

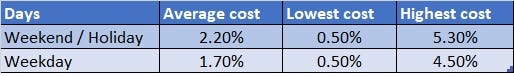

Biggest source of liquidity for foreign exchange is the inter-bank market. All the big financial institutions buy and sell currency in this market. Approximately 2 trillion* USD of transactions happen in this market on a daily basis. This market doesn’t operate on weekends and operates with limited capacity on public holidays. All remittances you do will be covered through the inter-bank market one way or the other. Your remittance efficiency drops on days when inter-bank market is not operational. This was confirmed in our data analysis where we looked at sending EURO to US Dollar. We analyzed hourly data across 15+ remittance providers for a week. Your cost of transfer is higher over the weekend. For live rate comparisons, visit CT-24.com.

Remittance providers do not change the cost from one hour to next. Cost of remittance is mainly changed for holidays.

Use a remittance aggregator

In previous sections, I have used the concept of “cost of remittance”. What does this mean ? Only thing that matters to you is how many US dollars can you receive when you send 1000 Euros. Big financial institutions get the best rate for currency conversions. This rate is called inter-bank rate. Cost of remittance is defined as a percentage change from this inter-bank rate. Your aim should be to achieve lowest cost. It is not easy to observe this cost when you use a single remittance provider as there are various hidden costs like FX rate, bid-offer spread, transfer charges etc. It is advisable to use a remittance comparison website like CT-24.com where you can compare the final amount you receive across various remittance providers along with inter-bank(mid) rate.